One of the top priorities of business owners should be to keep an eye on their accounts receivable turnover. Making sales and excellent customer service xero airbase integration is important but a business can’t run on a low cash flow. Collecting your receivables is definite way to improve your company’s cash flow.

Limitations of Accounts Receivable Turnover Ratio

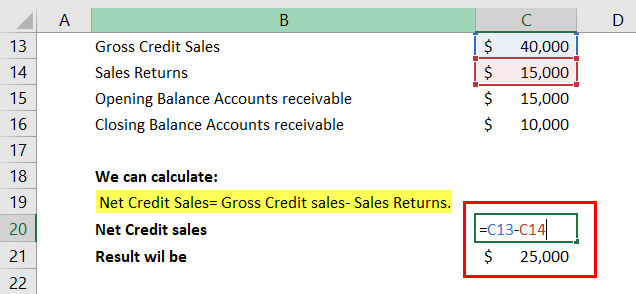

In other words, Alpha Lumber converted its receivables (invoices for credit purchases) to cash 11.43 times during 2021. You can use this average collection period information to compare your company’s receivables turnover time with that of other companies in your industry. Net credit sales is the amount of revenue generated that a business extends to customers on credit. This figure should exclude any product returns, allowances, and cash sales.

How Precision Neuroscience streamlined systems and slashed data entry with Ramp

An additional consideration is the use of baseline figures for the ratio calculation. Some companies use total sales instead of net sales, the result is an inflated ratio calculation. Companies may do this accidentally or for a specific reason, it is not necessarily a deliberate attempt to mislead investors. Regardless of the why Investors must remain vigilant and understand how a ratio is calculated before making decisions on whether to invest or not.

- Consider setting credit limits or offering payments plans for high dollar value sales.

- The accounts receivable turnover ratio, also known as the debtors turnover ratio, indicates the effectiveness of a company’s credit control system.

- For example, the accounts receivable turnover ratio is one of the metrics that business investors and lenders look at when determining whether to invest in or loan money to your business.

- Net credit sales are calculated as the total credit sales adjusted for any returns or allowances.

Why is it important to track accounts receivable turnover?

You still get your product, but the payment is deferred – meaning it is put off to a later time. As long as you get paid or pay in cash, sure, the act of buying or selling is immediately followed by payment. You must account for business context when analyzing an AR turnover value. However, it’s worth noting that a high ratio could also mean that you operate largely on a cash basis as well. It requires only 2 data fields to be filled accurately to give you the correct ratio. If you had to liquidate your business today, how much could you get out of it?

Billing on time and often will also help your company collect its receivables quicker. If you have a payment system for your sales, it is less daunting for your customers to pay smaller, regular bills than one large bill every quarter. Moreover, if you believe your business would benefit from experienced, hands-on assistance in accounting and finance, it’s always good to consult a business accountant or financial advisor.

11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. An accounts receivable is the sum of the beginning and ending account balances divided by two. The net credit sales come out to $100,000 and $108,000 in Year 1 and Year 2, respectively. Accounts closing is the amount of outstanding receivables at the end of the day. Accounts opening is the amount of outstanding receivables at the start of the day.

It is a quantification of a company’s effectiveness in collecting outstanding balances from clients and managing its line of credit process. The accounts receivable turnover ratio, or debtor’s turnover ratio, measures how efficiently a company collects revenue. Your efficiency ratio is the average number of times that your company collects accounts receivable throughout the year. An average accounts receivable turnover ratio of 12 means that your company collects its receivables 12 times per year or every 30 days.

The industries above are based on the top-level industry Standard Industrial Classification (SIC) codes. You can use these numbers as broad averages, but we recommend conducting additional research to find the A/R turnover for your industry-level SIC code. You can visit IBISWorld to look for research and data about your industry. In financial ratio analysis, it’s always the rule of thumb to look at industry information. What’s acceptable for a bookkeeping service company may not be acceptable for a photographer. An A/R turnover ratio of about 7 means that XYZ Company was able to collect its average A/R balance ($15,000) about seven times throughout the year.