Its primary purpose is to provide relevant and reliable financial information to external stakeholders, such as investors, creditors, regulators, and the general public. The information generated through financial accounting helps users make informed decisions about the company’s financial health and performance. It lists the company’s assets, liabilities, and equity, and the financial statement rolls over from one period to the next. Financial accounting guidance dictates how a company records cash, values assets, and reports debt. In accounting, decision-making is the process of choosing between two or more courses of action to achieve the desired outcome.

- You can use these MCQs to help prepare for your exams, interviews, and professional qualifications.

- Experience with this process reflects the ability to handle high-pressure situations and attention to detail, synthesizing complex data into clear reports.

- A balance sheet is used by management, lenders, and investors to assess the liquidity and solvency of a company.

- By analyzing this data, accountants can make informed decisions to help the company achieve its goals.

- The end result is a financial report that communicates the amount of revenue recognized in a given period.

Explore Products

Balancing diplomacy with firmness ensures client satisfaction while adhering to financial accuracy, reflecting an understanding of the broader implications of financial disputes. For example, imagine a company receiving a $1,000 payment for a consulting job to be completed next month. Under accrual accounting, the company is not allowed to recognize the $1,000 as revenue, as it has technically not yet performed the work and earned the income. Nonprofit entities and government agencies use similar financial statements; however, their financial statements are more specific to their entity types and will vary from the statements listed above. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching.

Why You Can Trust Finance Strategists

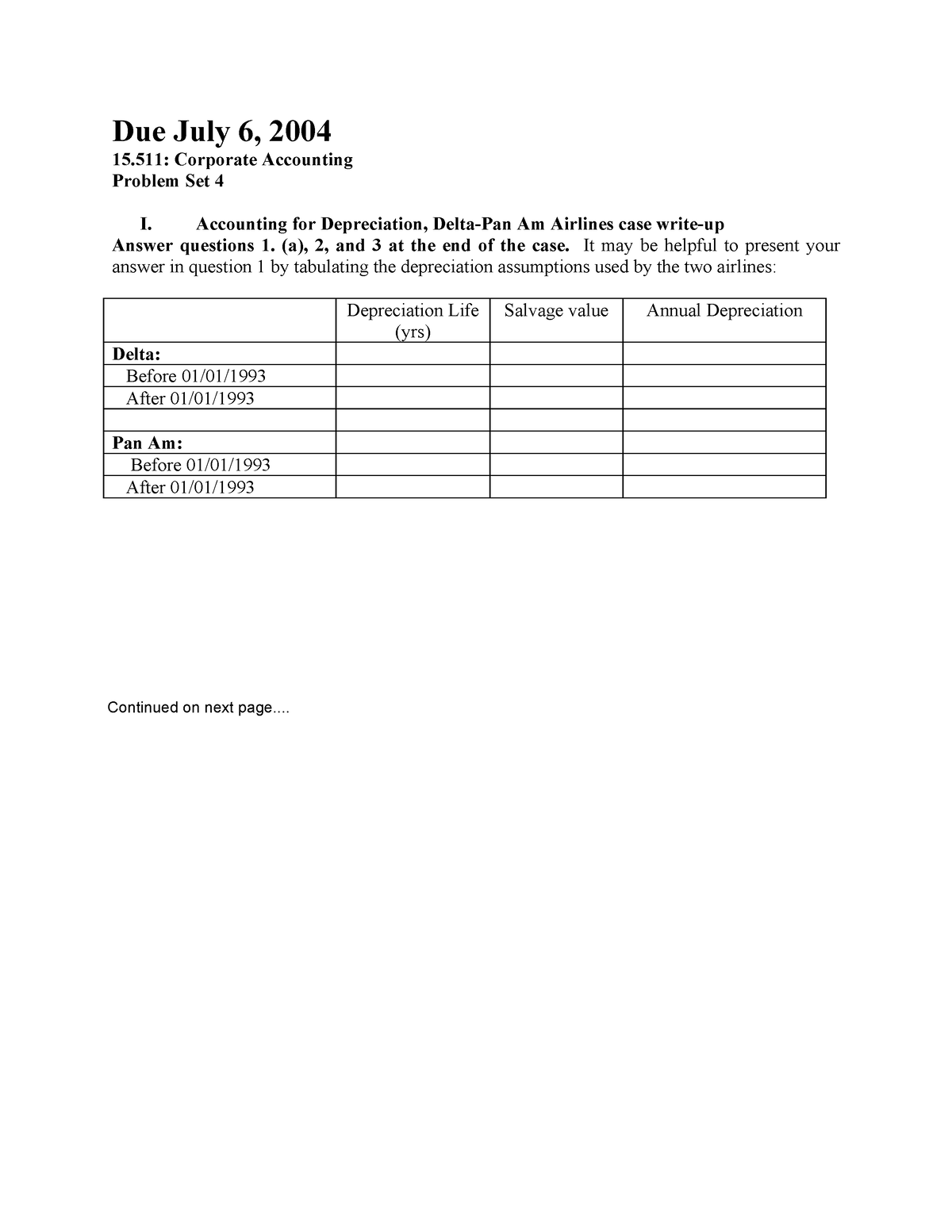

Communicating financial information to non-financial stakeholders involves translating data into clear insights that drive decisions. Bridging the gap between financial concepts and strategic goals requires technical proficiency and the ability to tell a compelling story with data. Managing fixed assets involves tracking depreciation, maintenance, and compliance. Understanding these factors ensures accurate reporting and maximizes asset value, requiring strategic thinking and attention to detail.

Shareholders’ Equity Statement

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and what is price variance innovator in teaching accounting online. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. Ensuring accuracy in complex tax returns is vital for maintaining integrity and reputation.

With OnlineExamMaker software, you can easily enhance your assessment procedures, save time on grading, and gain valuable insights into learner performance. OnlineExamMaker grades quizzes automatically, and gives you access to detailed exam reports and statistics instantly. The insightful analytics help teachers and trainers gain valuable insights, enabling them to optimize their teaching methods.

Financial accounting plays a critical part in keeping companies responsible for their performance and transparent regarding their operations. A cash flow statement is used by management to better understand how cash is being spent and received. It extracts only items that impact cash, allowing for the clearest possible picture of how money is being used, which can be somewhat cloudy if the business is using accrual accounting. Financial accounting rules regarding an income statement are more useful for investors seeking to gauge a company’s profitability and external parties looking to assess the risk or consistency of operations.

Revenues and expenses are accounted for and reported on the income statement, resulting in the determination of net income at the bottom of the statement. Assets, liabilities, and equity accounts are reported on the balance sheet, which utilizes financial accounting to report ownership of the company’s future economic benefits. The accrual method of financial accounting records transactions independently of cash usage. Revenue is recorded when it is earned (when a bill is sent), not when it actually arrives (when the bill is paid).